Journal ofDairy & Veterinary sciences Juniper Publishers

Authored by Bathathu Peter

Abstract

In 2017, the fruit industry was ranked the 7th largest exporter and the largest agricultural exporter in South Africa. South Africa has prioritized exports as the engine for economic growth and job creation. The country has two major export destinations namely; the high-income countries of Europe and North America, and the low-income markets of Africa, especially Southern African Customs Union (SADC) countries. South African fruit industry is operating under a volatile Real Exchange Rate (RER). There has been a proliferation of debates on the relationship between the RER and exports performance. The most commonly held belief is that the volatile RER depresses exports due to increased risk of trading activity. A volatile RER has posed a serious challenge to policy making environment as the magnitude of its impacts on exports is still unknown. The policy making environment becomes stagnant. The South African fruit producers are unable to anticipate income earnings from exports due to increased risks associated with RER. South Africa’s agricultural sector encompasses the Historically Disadvantaged Individuals (HDI) which the country wants to give opportunities to export. The risks associated with the RER impair the development of the HDIs.

The paper seeks to examine the effects of the RER on export competitiveness of South African fruit industry. Data for the period of 1980 to 2015 is used to estimate the export demand equation. The paper employed the export demand equation to estimate the relationship between RER and South African fruit export. The relative prices and world income were also included in the model; where relative prices were used an indicator of fruit export competitiveness and foreign income represent the export demand. The results produced a significant inverse relationship between the relative price and South Africa’s RER. This imposes more pain on the development of the HDIs in South Africa’s agricultural sector. South Africa has desire to move away from the export of raw materials and traditional export commodities and promote the export of value-added products, including the agro processing products. Accordingly, this affects the entire value chain of the agricultural sector, since trade cannot be anticipated.

Keywords: The Competitiveness; South African Fruit Industry; The Effects of Real Exchange Rate

Abbrevations: HDI: Historically Disadvantaged Individuals; RER: Real Exchange Rate; SADC: Southern African Customs Union; GDP: Gross Domestic Product; FDI: Foreign Direct Investment; GVC: Global Value Chain; FDI: Foreign Direct Investment; UK: United Kingdom; EC: European Commission; EU: European Union; CBS: Citrus Black Spots; AGOA: African Growth and Opportunity Act; PPP: Purchasing Power Parity; GVC: Global Value Chain; CA: Current Account; ADF: Augmented Dickey Fuller

Introduction

South Africa is one of the most diverse and promising emerging economies globally [1]. It is located at the tip of the African continent and is the key investment location and a “gate way to Africa”. It offers a unique combination of highly developed First World economic infrastructure within a vibrant emerging market. Furthermore, it is one of the most advanced, broad-based industrial and productive economies in Africa. South Africa has two major export destinations: the high-income countries of Europe and North America, and the low-income markets of Africa, especially the Southern African Customs Union (SADC) countries. Correspondingly, South Africa’s exports to non-traditional markets such as India and China have been increasing rapidly. According to the Central Intelligence Agency [2], South Africa’s main export partners for all products are China, the United States, Japan, Germany, and India. While the main import partners for all products are China, Germany, Saudi Arabia, the United States, Japan and India.

Exchange rates fluctuated widely after the collapse of the Bretton Woods system of fixed exchange rates in 1973 [3]. There have been a considerable amount of debates and research papers that have attempted to establish the relationship between the exchange rate and exports performance, however, the magnitude and the extent of the effects of the exchange rate on trade are still unknown. The most commonly held belief is that exchange rate volatility depresses trade thereby increasing riskiness of trading activity. Most researchers believe that the exchange rate alone does not affect trade but the volatility of the exchange rate affect trade. South Africa is not isolated from the raging debates. Researchers and the policy makers hold divergent opinions and beliefs about the issue; the policy making environment become stagnant. Research is still essential to gain enough insight and to contribute to the debates and the economic policy making environment. Thirlwal & Husain [4] argue that the extent of the South African exchange rate volatility is probably related to the uncompetitive production and export structure of the country. South African fruit exports do not escape the exchange rate effects and the associated uncompetitive production. There is limited literature and research papers that focused on South African fruit industry, although it has been playing a major role on South Africa’s agricultural exports for some time.

Risk-adverse exporters are not willing to trade if the exchange rate is unfavourable. Exchange rate does not affect trade alone but also other macroeconomic variables like investment, inflations, employment, interest rates, and the Gross Domestic Product (GDP). Large fluctuations of currency may have adverse effect on longrun export performance and on Foreign Direct Investment (FDI). Principal exporters and foreign investors may be cautious against currency risks, but the cost of caution may be very expensive as the volatility of the currency increases to higher levels. This paper seeks to explore the effect of RER on export competitiveness of South African fruit industry.

Competitive Environment of South African Fruit Industry

Competitiveness is defined as: Firstly; “the ability to face competition and to be successful”. Secondly; “the ability to sell products that meet demand requirements and, at the same time, ensure profits over time that enable the firm to prosper” [5]. The World Bank [6] Purchasing Power Parity outlined that trade growth has moved beyond trade policy issues. The aim is on establishing an environment conducive to the emergence of firms that are competitive in both export and domestic markets. Competitiveness is central to stimulating private sector growth and employmentcreation [6]. This is important to eliminate poverty and increase the incomes of the poor. Better integration into global trade and investment helps firms to be competitive. Trade competitiveness is not only about exports and export performance, but the result of strong interdependence between imports and exports, as well as international flows of capital, investment and know-how [7]. Developing countries can benefit from trade and investment and from a range of ideas that come from developed countries. The emergence and endurance of Global Value Chain (GVC) is critical for the developing countries [8]. The flow of knowledge from developed to developing countries often takes place in the context of vertical trade and value chains. Taking advantage of the GVC structure is a key determinant of industrial development in the 21st century. Developing countries can industrialize by joining GVCs instead of building their own value chain from scratch.

South African fruit is grown in the Eastern and Northern Transvaal, Natal, and the Eastern and the Western Cape. Page & Stevens [9] identified the countries under the European Commission (EC) as South Africa’s major markets for fruits. In 2015, the major export destinations for South African fruit were the Netherlands, the United Kingdom (UK), Germany, France, Italy, and other countries in the European Union (EU). South Africa’s fruit exports to the world were ranked number 11 in 2015. South Africa is a major external supplier to the EU market, competition from Chile became increasingly important. South African fruit industry is the main role player in the Southern Hemisphere, with about 60% of its production being exported. South African fruit industry is supported by 213 export companies [10]. South Africa’s ability to successfully penetrate the EU market, suggests that import controls may not have been a major constraint. The growth in value of fruit exports however dropped to 4%, from 7% in 2014. For citrus and grapefruits growth rates dropped to 2% in 2015, from 10% and 12% in 2014, respectively. While, growth rates for apples increased from -14% in 2014 to 2% in 2015.

Under the Lome’ IV agreement, it was negotiated that there should be a progressive abolition of customs duties on other citrus fruits that South Africa export. South African citrus fruits experiences Citrus Black Spots (CBS) in some markets like the EU and the U.S. South Africa’s neighbours consider that its size and its access to ports and ownership of shipping companies give it a strong inherent advantage. This is supplemented by recognition of its brand name in the European market. They, on the other hand, have the advantage of earlier ripeness as well as their current preference margin. However, preferences that are beyond that normally available to a developing country would give South Africa an advantage over potential competitors in Latin America. In turn, it could forfeit North American markets from any special arrangements by the U.S. with Chile or with other Latin American producers. Chile has emerged as an important competitor recently. Although it satisfies the US market first, its improved quality and output has increased its sales in Europe.

The South African fruit industry is vital to the South African economy. In 2013, the industry contribution to the total agricultural production was about 20% (4 million tons). Olivier, Fourie and Evans, regarded the South African citrus industry as the one billion U.S. dollar industry. The country exports about 42% of its fresh fruit production accounting for about 75% of all farm income for fruits. In the Southern Hemisphere, competing industries are ranked in terms of average growth in export volumes. However, the market requirements are constantly changing, and competition is fierce due to the oversupply of fruits in major markets.

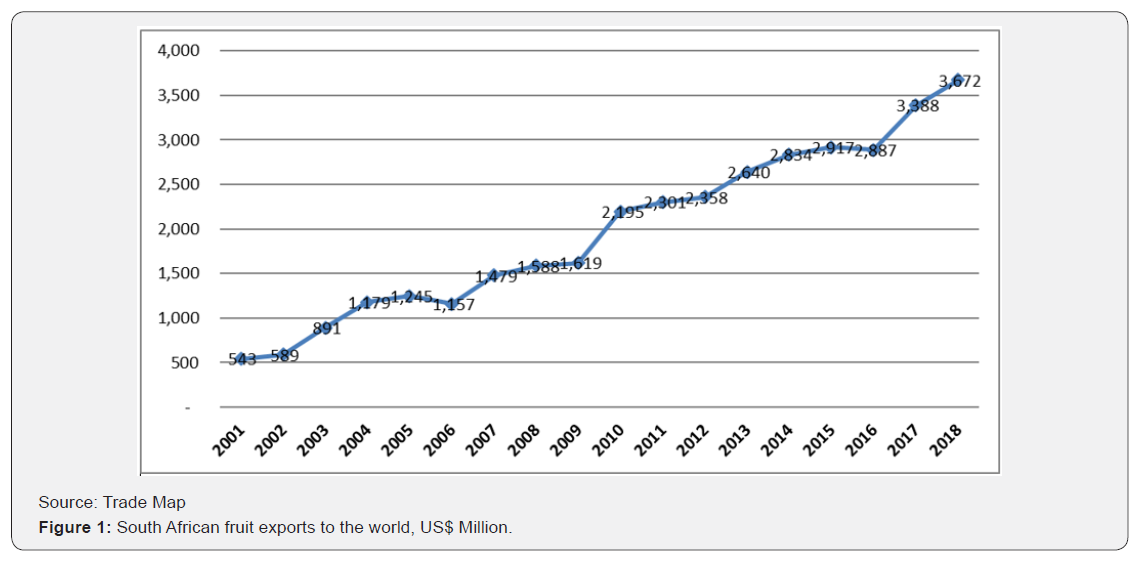

South African fruit exports: 2001 to 2018

In 2018, South Africa’s fruit exports recorded US$3 672 representing 8.4%-point increase from US$3 388 reported in the previous year, 2017. It is worth noting that South Africa’s fruit exports have been increasing substantially in the past three years. The industry has been operating under challenging trade conditions like the volatile currency and the strict trade restrictions such as sanitary and phytosanitary (SPS) measures to its major trade partners (Figure 1). In 2018, South Africa major trading partners for fruit exports were; Netherlands (20%), United Kingdom (15%), Hong Kong China (8%), United Arab Emirates (6%), and the Russian Federation (5%). Netherlands has been South Africa’s leading trade partner since 2008 and continued to be a leading role player in the market. Before 2008, the United Kingdom (UK) was the main trading partner for South Africa before overhauled by Netherlands. Table 1 presents a list of South Africa’s main importing markets for fruit in 2017. In 2017, South Africa exported US$3 388 million worth of fruit to the world, of which US$677 million worth of fruit was destined to Netherlands, and US$497 million was exported to the United Kingdom. South Africa continues to maintain a positive trade balance for fruit exports with both; The World and its leading trade partners for fruit.

Export growth figures between 2013 and 2017, displays evidence of an increasing growth in China and the Viet Nam. While South Africa is exporting more fruits to Netherlands and the United Kingdom, the market is growing significantly in the partners. South Africa is part of the Brazil, Russia, India, and China (BRIC) countries and is also enjoying benefits of exporting its products duty free under the African Growth and Opportunity Act (AGOA) of the United States of America (the U.S.A.). As a result, South Africa is facing zero per-cent tariff rate in Hong Kong China and the in the United States.

The theory of Purchasing Power Parity (PPP)

The theory of Purchasing Power Parity (PPP) was used in the 1920’s mainly to evaluate the correct value of currency to gold [11]. It is sometimes called the ‘inflation theory of exchange rates’ [12]. It has been argued that there would be no meaningful way to discuss over or under valuation of the exchange rate without the PPP theory [12]. The value of a country’s currency is measured with what it can purchase. This theory states that, “the equilibrium exchange rate enables people to buy the same amount of goods and services in any country for a given amount of money” [13]. Therefore, once exchange rates are considered, the average price of goods and services across countries should be equal. Taking two countries South Africa and the U.S., Equation 2.5 shows the exchange rate as:

where; R/$ is the rand price of the U.S. dollar, PR is the average price of goods and services in South Africa, and P$ is the average price of goods and services in the U.S. Equation 2.5 represents the absolute PPP [14]. Equation 2.5 can be measured, as exchange rates, in a way that relative price of inflation determine the currency appreciation or depreciation across countries [13]. The PPP theory considers the acceleration of transactions between countries. Therefore, exchange rates should be correctly specified in relations to prices of different countries [15]. This theory assumes that:

a. There is only one good or that goods are similar

b. There are no barriers to trade, taxes, tariffs or transaction costs; and

c. There is internal price flexibility. The theory holds that in the long run, exchange rates will adjust to equalise the relative purchasing power of currencies [16].

This relates to the law of one price. The law of one price aligns the price of goods and services across countries [17]. The PPP relies on the Law of one price which holds that in a competitive market, identical goods will sell for identical prices when valued in the same currency [18]. As seen in Equation 2.5 the price of South African goods should be equal to the price of another country’s goods multiplied by the exchange rate. If the exchange rate is too high or too low the prices of a good will adjust if exchange rates are flexible. But if exchange rates are fixed only internal price will adjust as there would be an excess demand in one country and deficit in another. This theory deliberates on the relationship between exchange rates and relative price movements between countries. Because the exchange rate is endogenous in the PPP theory, there is a need to explain why exchange rate will change if is not in equilibrium.

Relevant Empirical Literature

The volatile RER is assumed to hinder trade and to affects the Current Account (CA) balance of any country. Volatile exchange rate creates uncertainty about the profits on trade. Exchange rate risk for all countries is generally not hedged because forward markets are not accessible to all traders. Some scholars argue that exchange rate could have positive effect on trade. The dominance of income effect over substitution effect could lead to a positive relationship between exchange rate and trade. Todani & Munyama [19] proved that there is no statistical relationship between South African export flows and exchange rate volatility. But when the significant relationships exist, it is positive. While, Takaendesa, Tsheole & Aziakpono [20], and Edwards and Lawrence provided evidence that exchange rate volatility has a negative effect on South African exports to the U.S. On the other hand, Abeysinghe & Yeok [21] provided evidence that depreciation stimulate exports and restrain imports. Appreciation is detrimental to exports and encourages imports while affecting the competitiveness. Mtonga [22] examined the effect of exchange rate variations trade competitiveness of South African exports. The results confirmed a significant damage on trade competitiveness.

Schaling [23] confirmed that RER depreciation is detrimental to exports. Basically, RER depreciation deteriorates exporter’s profits. Schaling [23] argues that South Africa’s monetary authorities should be interested in targeting competitiveness via the RER which is also correct technique to narrow the present inflation targeting band. Raddats, Schaling & Kabundi, Matlasedi, Ilorah, & Zhanje, and Rowbothan, Saville, & Mbululu [24-26], confirmed that exchange rate has a positive effect on South African exports. While, Sekantsi [27], Muzenda, Chamunorw & Choga, Chiloane, and Khosa confirmed a negative effect. RER exchange rate has negative effect on South Africa’s trade balance. Edwards & Garlick believe that exchange rate enhances export competitiveness, encourages export diversification, protects domestic industries from imports, and ultimately improves the CA trade balance for South Africa.

Edwards & Garlick reviewed the theoretical and empirical relationships between the exchange rate and trade flows in South Africa. They concluded that trade flows are sensitive to exchange rate. The nominal depreciation has the limited long-run impact on trade volumes and the trade balance. The RER volatility can have a detrimental effect on South Africa’s export competitiveness. Bella, Lewis, & Martin [28] account that assessing a country’s competitiveness should customarily start with the analysis of its real exchange rate. Competitiveness assessment is crucial in evaluating a country’s macroeconomic performance and the sustainability of its policies. On South Africa’s trade competitiveness, Mtonga [22] provided evidence that exchange rate fluctuations have adverse effect on trade competitiveness. Ajuruchukwu, Ndou, and Peter attested that exchange rate boosts the competitiveness of South Africa’s agricultural exports.

Econometric Model Specification

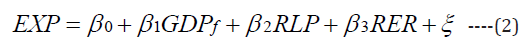

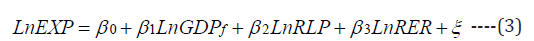

The paper adopts the export demand equation to estimate the effect of RER on export competitiveness of South African fruit industry. The RER and South Africa’s fruit exports are the main variables in the model. Relative fruit export price and the foreign income, represented by the world GDP (Gross Domestic Product), are included in the model to capture competitiveness through price elasticity of demand and foreign income to determine the external demand. The model takes the following form:

where: EXP represents South Africa’s real fruit exports; GDP represents the world foreign income; RLP is the Relative Prices; RER is the Real Exchange Rate and represents the ξ = Error term. The data is transformed to a logarithmic form as follows:

Natural logs of the variables are used rather than the original raw values. Log transformation works in the data where the residuals get bigger for the bigger values of the dependent variable (Hamilton, 1994). Trends in the residuals occur repeatedly because the error or change in the value of an outcome variable is often a percentage of the variable rather than an absolute value. For the same percentage error, a bigger value of the variable means a bigger absolute error and bigger residuals. Therefore, transforming data into logs pulls in the residuals for the bigger values [29].

Description of Variables

Real Fruit Exports (EXP)

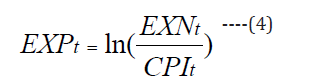

A time series data for South Africa’s real fruit exports for the period 1981 to 2015 was selected for analysis. The South African fruit exports consisted of the following cultivars; apples, apricot, grapes, pears, peaches, plums, avocadoes, pineapples, oranges, lemons and limes, grapefruit, and naartjies. South Africa’s fruit exports are constructed as the nominal fruit exports deflated by the Consumer Price Index (CPI). Equation 3 demonstrates how South Africa’s real fruit exports are calculated:

where; EXPt represents South Africa’s real fruit exports, EXNt represents South Africa’s nominal fruit exports, and the CPIt is South Africa’s Consumer Price Index. South Africa’s real fruit exports are extremely volatile.

World Gross Domestic Product (GDP)

Because the demand for any consumer is affected by the changes in income; for that reason, foreign income is used to determine the external demand for South Africa’s real fruit exports. In this instance, the total value of the amount of good and services produced and sold in the world, the Gross Domestic Product (GDP) is used as an indicator for the foreign income.

Relative Prices (RLP)

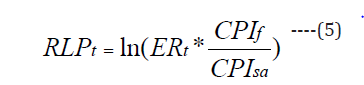

The nominal price of a good is its value in terms of money. The relative price is its value in terms of some other goods. The term relative price is used to make comparisons of different goods at the same moment of time. The bilateral trade between two countries depends, among many others, on the exchange rates and the relative price. Therefore, Todani and Munyama derived the following definition for the relative price:

where; RLP represents the relative prices, ER is the exchange rates, CPIf is the consumer price index for the foreign countries (the world), CPIsa is South Africa’s consumer price index. The insertion of RLP for South Africa’s fruit exports intends to capture the competitiveness of fruit export to the rest of the world. Because exchange rates affect the price, it is essential to include them in calculating the RLP. Price of exports has also been used as the indicator for export competitiveness by Fountas and Aristotelous. The variable is highly affected by the RER.

Real Exchange Rate (RER)

The main interest of the paper is on the effects of RER on the competitiveness of South Africa’s fruit export. The RER explicitly addresses the ultimate objective of the paper. The examination of the relationship between RER and export has been subject of debate since early 1970s. The data used for the RER extends from 1980 to 2015.

An Error Term (ξ)

An error term, ξ, represents the influence of all other variables excluded in the model Harris [30]. The excluded variables are presumed to be random such that ξ has the following statistical properties: 1) has zero mean (E (ξ) = 0), 2) has constant variance (E (ξt2) = δ2) and 3) is uncorrelated with its own parts (E (ξt ξt-1) = 0). If these assumptions hold, the coefficients of the estimates will be unbiased.

Preliminary Data Examination

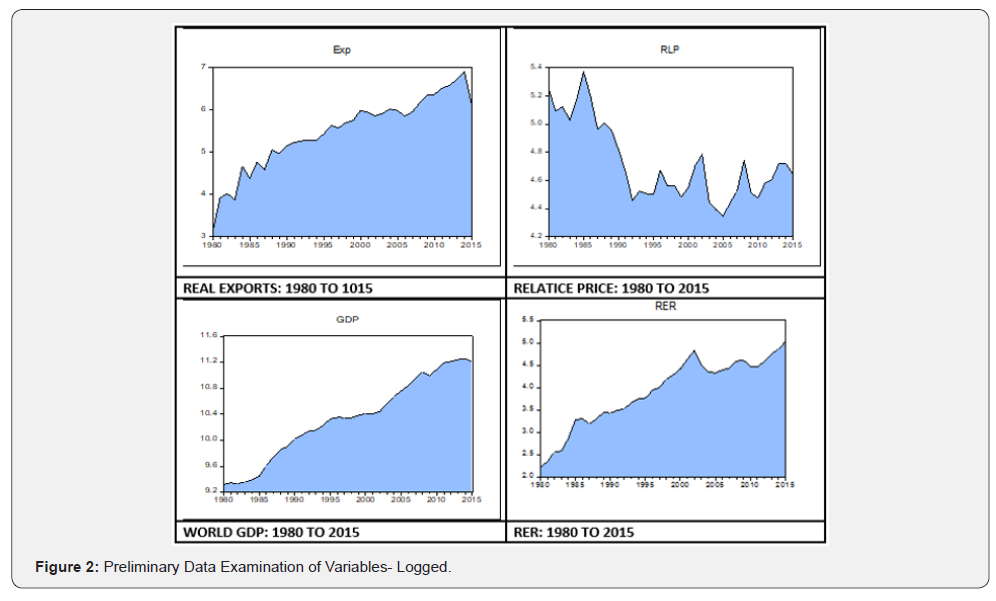

Figure 2 present the results of the plots. The data was transformed into logarithms for all variables included in the model. EXP, RER and the GDP displays considerable upward trends. This gives a suspicion that the positive relationship can be expected between these variables. The RLP is relatively volatile throughout the period. This variable is decreasing with time while the EXP is increasing. An inverse relationship between these variables can be expected. All these variables play a significant role to determine the level of South African fruit exports. Trends in the variables give an indication that the series may not be stationary and that there may be a need to include the intercept and a trend when testing for stationarity. Furthermore, the constant does not revolve around the zero mean, this means that a constant also need to be included in the model.

Test for Stationarity

Augmented Dickey Fuller (ADF) Unit Root Test

Table 1 presents the results of the ADF unit root test. The results suggested that the series was not stationary, and it was necessary to be modified by differencing and inclusion of a trend and the intercept. The foremost aim is to test null hypothesis that the variables has a unit root test. The least squares method is followed, and the maximum lag length selected is 9. In Table 1, the probability is zero, this indicates that the t-statistics is highly significant at 5%. The Augmented Dickey-Fuller t-statistic is greater than the t-statistics critical values at 1%, 5%, and 10% levels in absolute values, meaning that the null hypothesis that the variables have the unit root test is rejected. Basically, these results suggest that the series is stationary and can be used at its present form.

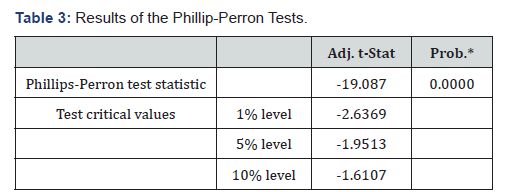

Phillips-Perron Test

Table 2 presents the results of the Phillip-Perron test. The series was differenced twice with no intercept and a trend. The null hypothesis tested here is that the variables have the unit root. In Table 2, the probability is zero, signifying the high level of significance. The adjusted Phillips-Perron t-statistic is greater than the test critical values at 1%, 5%, and at 10% level. Therefore, the null hypothesis that the variables have the unit root is rejected. This also confirms that the series is stationary.

*MacKinnon (1996) one-sided p-values.

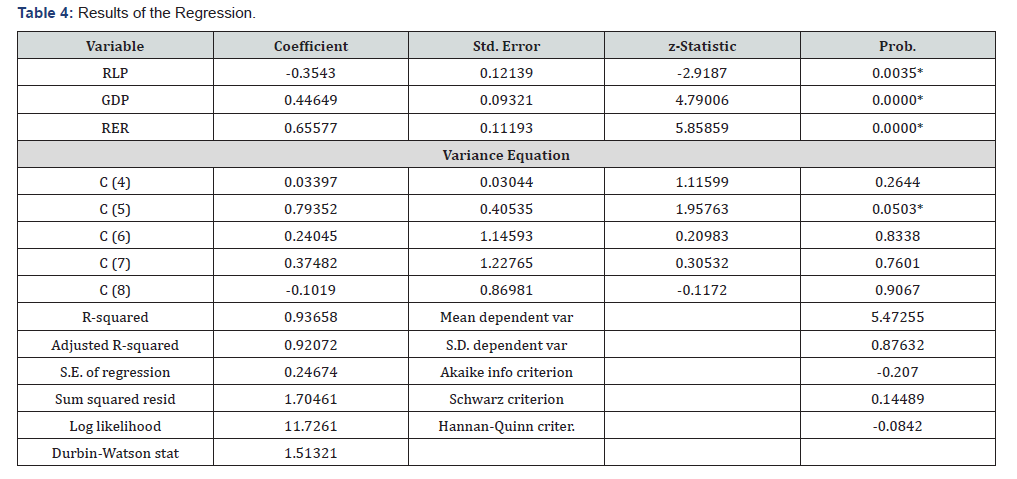

Results

Table 3 presents the results of the regression model employed. South African fruit exports (EXP) were regressed on relative prices for food exports (RLP), world Gross Domestic Product (GDP) as the indicator for foreign income, and the Real Exchange Rate (RER) volatility. The first panel of the results presents the regression coefficients, the standard errors, z-statistics, and the p-values. The second panel of the results presents the variance equation of the regression coefficients. The third panel of the results presents the statistical properties of variables. A Maximum Likelihood- Autoregressive Conditional Heteroskedasticity (MLARCH) method was followed, and the Component ARCH (1,1) was selected. The ML method try to capture estimators that maximise the possibility of observing the sample used. In Table 3, zero probability values are a strong indication of significance. The probability values also confirm that the likelihood of the results occurring randomly is very low. The Z-statistic is greater than the absolute value 2, this implies that variables are all statistically significant at 5% [31,32]. The results present the Z-statistics instead of the t-statistics, this means that normality can hold asymptotically [32]. The coefficients of the results presented in Table 3 can be fitted in an econometric model as below:

EXP = −0.101910 + (−0.354304RLP) + 0.446494GDP + 0.655772RER -(6)

*MacKinnon (1996) one-sided p-values.

R2 = 0.94, Adjusted R2 = 0.92. The overall results of the regression confirm the good fit of the model. The results of the regression are interpreted in detail below (Table 4).

*=indicate significance at 5%

Source: Computed from E-Views.

Dependent Variable: EXP.

Method: ML - ARCH (Marquardt) - Normal distribution.

Relative Price (RLP) and Real Fruit Exports (EXP)

The results show that a one unit (1%) change in RLP will result in to 0.35 unit (35%) change in the value of EXP, when all other factors are fixed. An inverse relationship between RLP and EXP is established. This means that the RER has a significant negative effect on the South Africa’s export competitiveness of the fruit industry. This validates the theory that says RER affects the relative price between countries [33]. South Africa’s real fruit exports become less competitive abroad when its price levels increase relative to the world price levels. Similarly, they also become more competitive when the South Africa’s general price levels decrease relative to the world price levels. The empirical evidence confirms positive relationship between real exports and the relative prices. Todani and Munyama analysed the effects of exchange rate volatility on aggregate South African exports flows to the world. They also used the relative prices as the indicator of international competitiveness. The results suggested the positive relationship between the two variables. Similarly, Gherman, Stefan, and Filip [34] examined the relationship between the exchange rate of Romanian currency and the Consumer Price Index (CPI). A significant positive relationship between the two variables was also established. Kinya, Muthamia, and Muturi examined the relationship between tea export earnings and the tea prices, among other variables. Their results also confirmed a significant direct relationship between Kenyan tea exports and tea prices. The inverse relationship between South Africa’s fruit exports and the relative prices contradicts empirical evidence provided in this study. However, there may be other researchers that established an inverse relationship as well.

World Gross Domestic Product (GDP)

The second coefficient is the world GDP (Gross Domestic Product) used as the proxy for foreign income. A significant positive relationship between the world GDP and South Africa’s fruits exports is established. The results suggest that, a one unit (1%) change in the world GDP will result to 0.45 unit (45%) change on South Africa’s fruit exports. In this instance, the results are not surprising, as this works like a budget of any consumer. High GDP means increased demand just as high consumer income translates to high demand. The law of demand states that, the higher the income the higher the quantity demanded. Harberger studied the relationship between economic growth and real exchange rate. The results affirm that there is no significant relationship between the two variables. Kinya, Muthamia, and Muturi, examined the determinants of earnings from tea export in Kenya, the foreign GDP was used as a proxy for foreign income. In this case, foreign income was used as the indicator for foreign demand. The results suggested that foreign income has indirect relationship with tea export earnings.

Real Exchange Rates (RER)

The RER is the main coefficient in the model. This variable captures the relationship between South Africa’s (RER) and South Africa’s real fruit exports (EXP). It also provides answers to the on-going debates and the beliefs on the effect of RER on export. The RER can also be interpreted as the relative price, and it basically affects the relative price of exports. The results suggest a significant positive relationship between the RER and South Africa’s fruit exports. Basically, holding other factors constant, a one unit (1%) increase in the RER will result to a 0.66 unit (66%) increase on South Africa’s real fruit exports. Was this relationship anticipated? The positive relationship may be attributed to the fact that South Africa’s RER has been depreciating since early 1970’s. The relationship established here is not new and can never be anticipated. Basically, either positive or the inverse relationship here was anticipated. This is where the researchers differ, and this is what makes the policy making environment become chaotic. While, some researchers suggest an inverse relationship other, including this thesis, suggest a positive relationship.

Obi, Ndou, and Peter, assessed the impact of exchange rate volatility on South Africa’s agricultural exports. Their results suggested a positive relationship between South Africa’s exchange rate volatility and agricultural exports. Todani and Munyama investigated the effects of exchange rate volatility on aggregated South African exports flows to the rest of the world and the results confirmed that there is no significant relationship but when it exists, it is positive. Gherman, Stafan, and Filip [34] also examined the relationship between exchange rate and exports. Their results also confirmed a significant positive relationship between the two variables.

Results of the Diagnostic Checks

The diagnostic check shown by the results includes R-squared, the adjusted R-squared, standard error, Sum Squared Residuals (SSR), log likelihood, Durbin Watson (DW) statistic, mean dependent variable, standard dependent variable, Akaike Information Criterion (AIC), scharz criterion, and Hannan-Quinn Criterion (HQC). The R-squared and the Adjusted R-squared are 93% and 92%, respectively. This confirms a strong goodness of fit of the model used. R-squared measures how variables moved in correlation to each other. It shows how the proportion of variability in the dependent variable is explained by the independent variables. In this instance, a 93% of the movement in the dependent variable is due to the independent variables. The Durbin-Watson Statistic is a bit below 2, showing the presence of serial correlation problem [32]. However, the Durbin-Watson statistic is within an acceptable range which is above 1.5. Therefore, the results of the regression can be interpreted. The model with the lowest AIC (-0.207004) and Schwarz criterion (0.144889) was selected. The low value of AIC and Schwarz criterion confirmed the robustness of the model [35]. Gujarati & Porter [35] reported that the lower the value of these criteria, the better the model is.

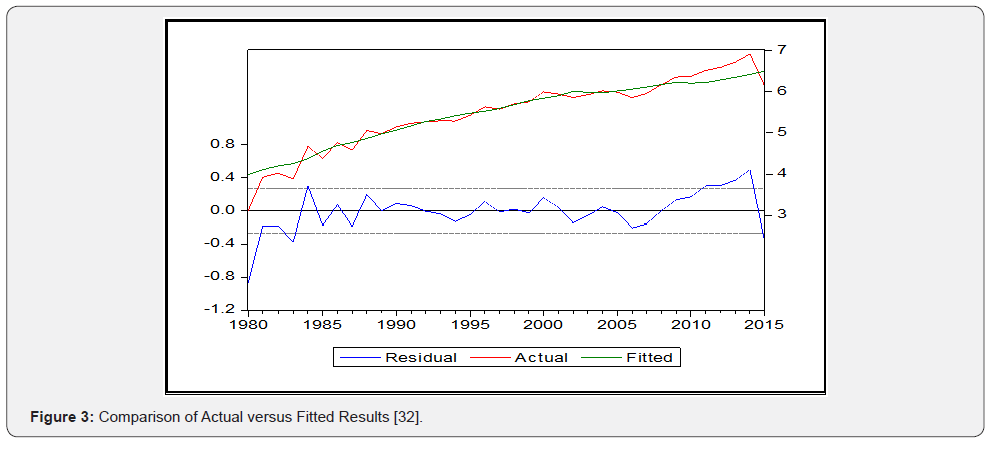

Actual Versus Fitted

The residuals are also presented, with the actual versus fitted graph, plotted with zero mean. Figure 3 presents the comparison of the actual versus fitted results plotted with residuals. In Figure 3, actual and the fitted lines increase simultaneously. This confirms a precise prediction of the dependent variable. The residuals plotted with the two standard errors, revolve around the zero mean. This confirms that the series of the dependent variable used in the regression model was stationary.

Normality Test

The normality test presents the histogram of the residuals along with their summary statistics. The summary statistics presented includes the mean, median, maximum, minimum, standard deviation, skewness, kurtosis, Jarque-Bera, and the probability statistics. Figure 4 presents the results of the normality test. Gujarati & Porter [35] accounts that for a series to be perfectly normally distributed, a measure of symmetry, skewness, should be zero and the kurtosis should be at least 3. Furthermore, the probability should be reasonably high as well as the Jarque-Bera static and should not be different from zero for the null hypothesis to be accepted. Gujarati & Porter [35] hold that the greater the probability of obtaining the Jarque-Bera statistic, the greater the evidence in favour of the null hypothesis that the error terms are normally distributed. In Figure 4, a high Jarque-Bera probability confirms the greater evidence in favour of the null hypothesis that the error terms are normally distributed.

Conclusion

The regression model for the export demand equation was estimated to establish the effects or RER on export competitiveness of South African citrus industry. Included in the model were the Real Exchange Rates, relative price of fruit exports, and the world GDP, with real fruit exports as the dependent variable. The probability values of the regression confirmed that the possibility that the results occurred randomly is very low. The results confirmed that one unit (1%) change in relative prices will result to 0.35 unit (35%) change in the value of South Africa’s real fruit exports. Most importantly, an inverse relationship between the relative price and South Africa’s real fruit exports was established. This means that RER has a significant negative effect on the South Africa’s fruit export competitiveness. The World Gross Domestic Product (GDP) coefficient confirmed a significant positive relationship with South Africa’s real fruit exports. The results suggested that, a one unit (1%) change in the world GDP will result to 0.45 unit (45%) change on South Africa’s fruit exports. The results also suggested a significant positive relationship between RER and South Africa’s real fruit exports. Results show that a one unit (1%) increase in RER will result to 0.66 unit (66%) increase on South Africa’s real fruit exports. Here, either positive or the negative relationship was anticipated.

The objectives of the paper were accomplished. South Africa’s fruit exports are said to be more competitive as a result of the depreciating RER relative to other currencies. This has been confirmed by the positive relationship between exports and the exchange rate. The results are supported by previous documented research, which emphasised that the weaker rand leads to more South African export commodities being absorbed by the international markets. This is because, the weaker rand means that South African products enter the international market at the lower prices compared to its rivals. This stimulates the competitiveness of South African fruit exports. Thus, the results reject the null hypothesis that RER depress competitiveness of South Africa’s real fruit exports.

The main policy changes in recent years include liberalising agricultural trade and deregulating the marketing of agricultural products; implementing land reform policies and programmes;abolishing certain tax concessions and reducing direct subsidies; reforming institutions governing the sector; and introducing a minimum wage for farm workers. South Africa adopted the export-led strategy to boost its economic growth and employment creation. The weaker rand gives South Africa an advantage in terms of international market penetration. Therefore, South Africa should take advantage of the depreciating RER. The RER volatility should be properly managed. The monetary authorities should adopt strict controls to stabilise the value of the rand. Because South Africa relies on the U.K. and E.U. as main trading partners, the existing barriers to trade, like the citrus black spot and the Euro Gap, should be identified and resolved. Investment in skills development for the new entrants is essential: small scale farmers lack skills, the government mentorship and training programs that are currently implemented will improve the skills.

To

Know More About Journal of Dairy & Veterinary sciences Please Click

on:

https://juniperpublishers.com/jdvs/index.php

To Know More About Open

Access Journals Publishers Please Click on: Juniper

Publishers

No comments:

Post a Comment